BlockFi – provide loans through cryptocurrency. The loans are provided to people who are looking to buy properties, cars, investment, credit card debt.

Q: What you do as lenders?

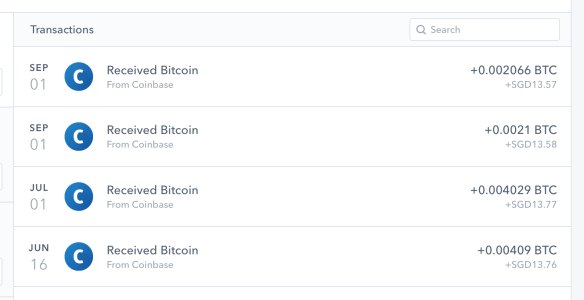

A: You lend your cryptocurrency (Bitcoin / Ethereum / Gemini Dollar) and earn the interest that is tagged to it

Q: How reliable is this company?

A: Valar Venture has invested 18.3m in them, Peter Thiel (Pay-pal cofounder) is one of the owners of this venture. There are another 2 other venture firms that invested in Blockfi.

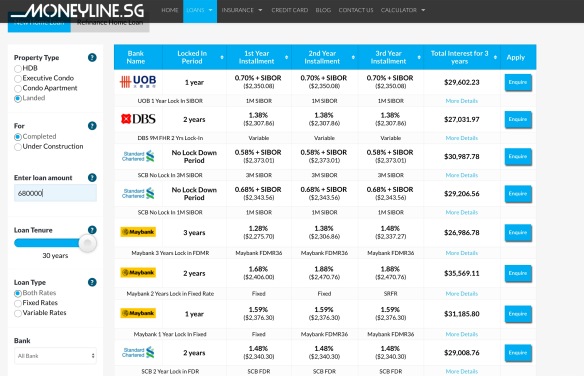

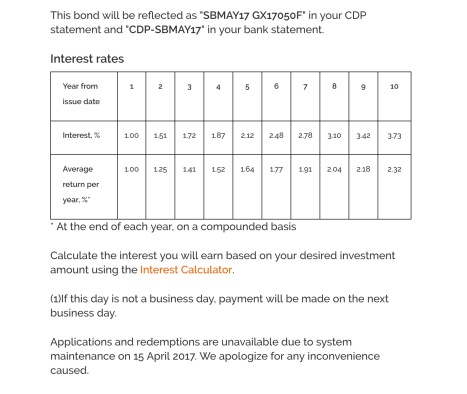

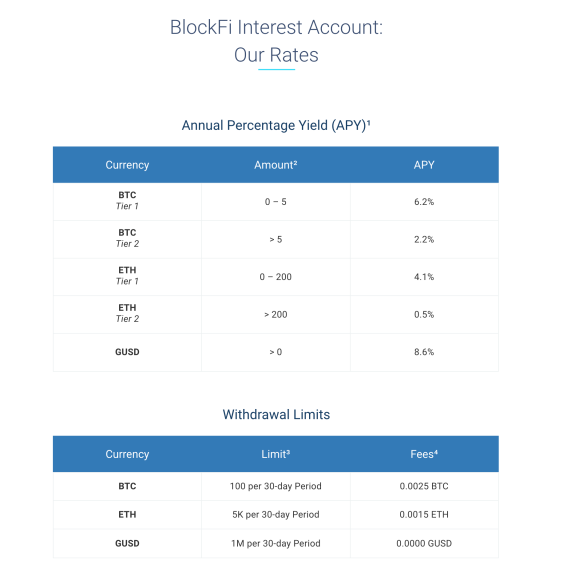

Q: What are the interest rates?

A:

Q: Why should I use your registration link?

A: Referral bonus for both of us. Sign up here!

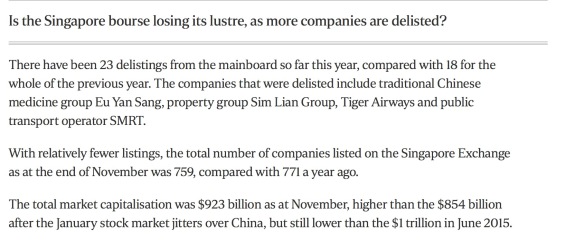

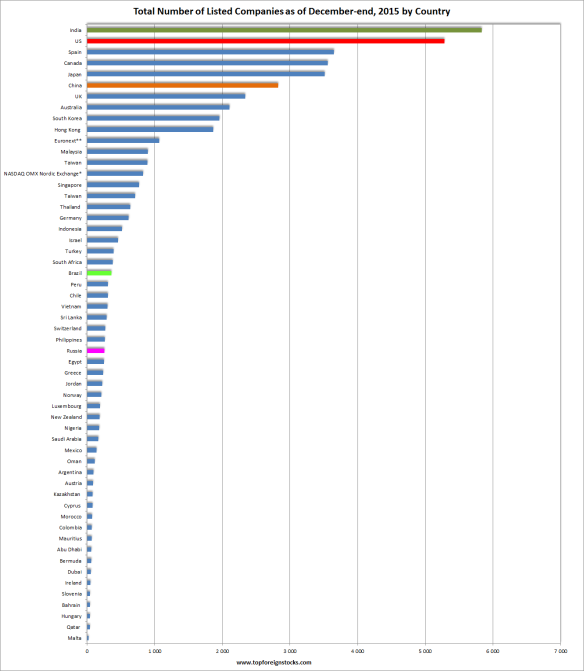

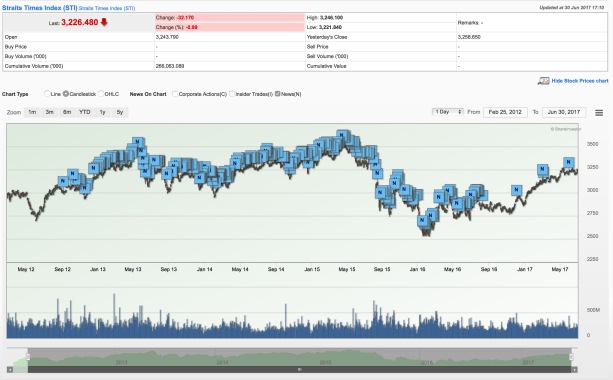

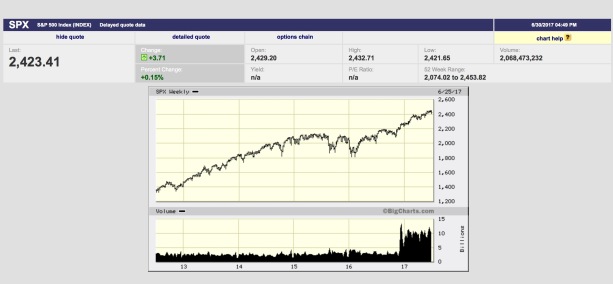

As you can see the STI trading volume only bounces below the $500 million dollar mark while the SPX (S&P) bounces around the $10 billion dollar mark. Higher the trading volume = Greater liquidity in the market. Liquidity in this context talks about the easiness to buy and sell shares that you own.

As you can see the STI trading volume only bounces below the $500 million dollar mark while the SPX (S&P) bounces around the $10 billion dollar mark. Higher the trading volume = Greater liquidity in the market. Liquidity in this context talks about the easiness to buy and sell shares that you own.