Some numbers are not provided due to the lack of available information

Constituted on 11 February 2010 | Warehouse Properties | Singapore, China & Australia | Portfolio value at 1.3 billion

-

IDENTIFICATION OF COMPANIES THAT ARE UNDERVALUED.

- Price to Book Ratio: 1.009 (overvalued by 0.9%)

-

LEARN ABOUT THEIR NUMBERS

- Gearing : 66.93% ( Above average reliance on financing for growth)

- Wale : 4.4 Years

- Current Ratio : 0.685 ( Unable to pay off short-term debts and long-term obligation if liquidated)

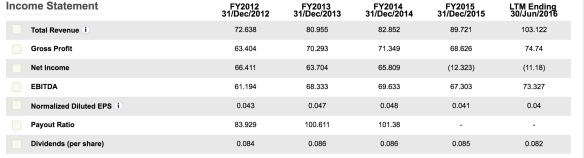

- Growth Rate : 7% (over 5 years)

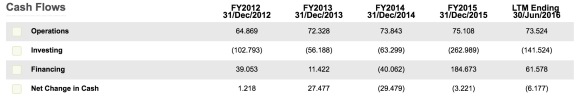

- Cash Flow Per Share : -0.0122

- Poor management ability ( Decreasing dividend payout | Net income decreasing| Poor cashflow management )

Still not a buy for me hais – due to the management’s ability! Anyway, I have just read finish Benjamin Graham – Intelligent investor!! It’s a really good read that advocates the importance of number! I’ll share more on what I’ve learned on the next post.

p.s I wanted to write about tax evasion…. but…. hais

How do u calculate gearing?

LikeLike

Hey Xz,

I use the calculation method of Total Debt Divided by Total Asset

LikeLike