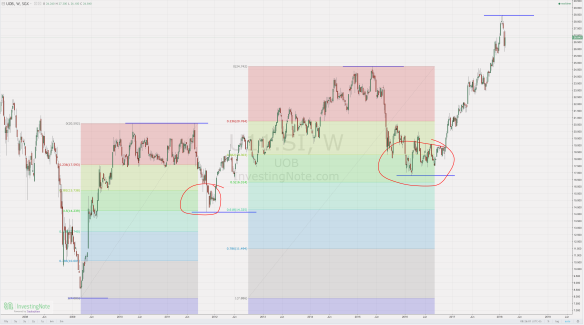

HK Land has recently come into the spotlight due to it’s current trading price (2010 price) and its domestic political issues. It seems like there’s a high correlation between its bearish short-term trend and it’s current civil unrest.

Would love to see price action trading at 3.825 level before executing a buy order instead of current price point. This come with the knowledge that many fund houses are pulling money out from equities in eagerness for a crash.

Doesn’t seem like a long wait, patience is what gives the greater value.

Remember we are betting on probabilities and not certainties.

Please do your own due diligence, i’m just alittle noobie