Like the Aspial Treasury, I couldn’t find much financial info on the treasury company, I will using the group’s financial number

Matures on 22 May 2020 | 3.65% | Semi-Annually coupon payment | Subsidiary of Fraser Centrepoint Limited | Started in 2011 |

1) IDENTIFICATION OF BOND BELOW PAR VALUE

- Current market value : 1.008 ($8 above its par value)

2) LEARN ABOUT THEIR NUMBERS

- Debt To Equity: 1.25 (Strong reliance on financing for growth) – But still better than Aspial

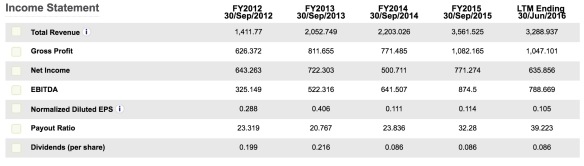

- Growth Performance: -16.94%

- Current Ratio: 1.84 ( Above average) – Genting is better

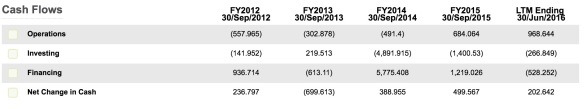

- Below average management ability ( Increasing dividend payout | average net income growth | Poor cashflow management)

The bond is used for the corporate reason such as refinancing loan, financing and increasing general working capital. The numbers are not to my liking and hence I won’t be entering and of course, I’m trying to get my bang for my buck