15 restaurants | Since 1991 | Famous for ginger chicken & Herbal Soups

Comparison will be done with Tung Lok Restaurants (540)

1) IDENTIFICATION OF COMPANIES THAT ARE UNDERVALUED.

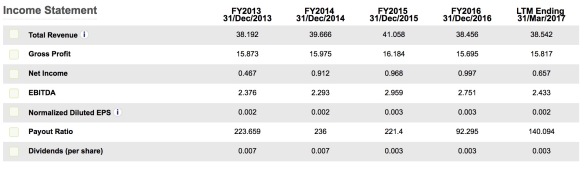

- Price to book ratio : 5.635 (463.5% Above fair value) 540 – 1.874

- Price to earning ratio : 81.826 ( Above industry standard – 86.29) 540 – 78.667

2) LEARN ABOUT THEIR NUMBERS

- Debt To Equity : 0.27% | 22.4%

- Growth Performance : -8.55 | Not given

- Dividend Yield : 2.77% [ 5 years] | 0% [ Doesn’t pay]

- Current Ratio : 2.27 |1.44

- Book Value per share : 0.0337 | 0.0577

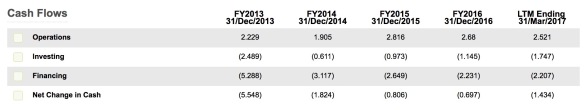

- Cash Flow per share : 0.0078 [Having negative cashflow for past 4 years]| 0.0208 (540) [3/5 years of positive cash flow]

- Weak management ability (No progressive Dividend Growth | Low net income/gross profit margin growth | Negative cash flow – price of stock is 25 times of its cashflow).

3) TECHNICAL ANALYSIS

Weekly chart price action shows that stock is in a bearish trend as market continues to make lower low and lower high. Stock has just entered into key price level, if broken, market has a higher probability of trend lower for a long time. A purchase order will put you in a 1:1 RR ratio.

4) Would I be vested ?

No!

Fundamental:

- Overvalued without any justification (Probably people bought it cause of the brand)

- 4 years of debt/equity numbers not filed in

- Poor growth rate

- Cashflow is so poor probably due to the reinvestment rate (to reduce financing)

- No dividend

Technical:

- Market in bearish trend

- Weak RR ratio

- Price got legroom to 0.118